Rare earth metal production was on the rise again in 2024, jumping to 390,000 metric tons worldwide — that’s up threefold from 132,000 metric tons in 2017.

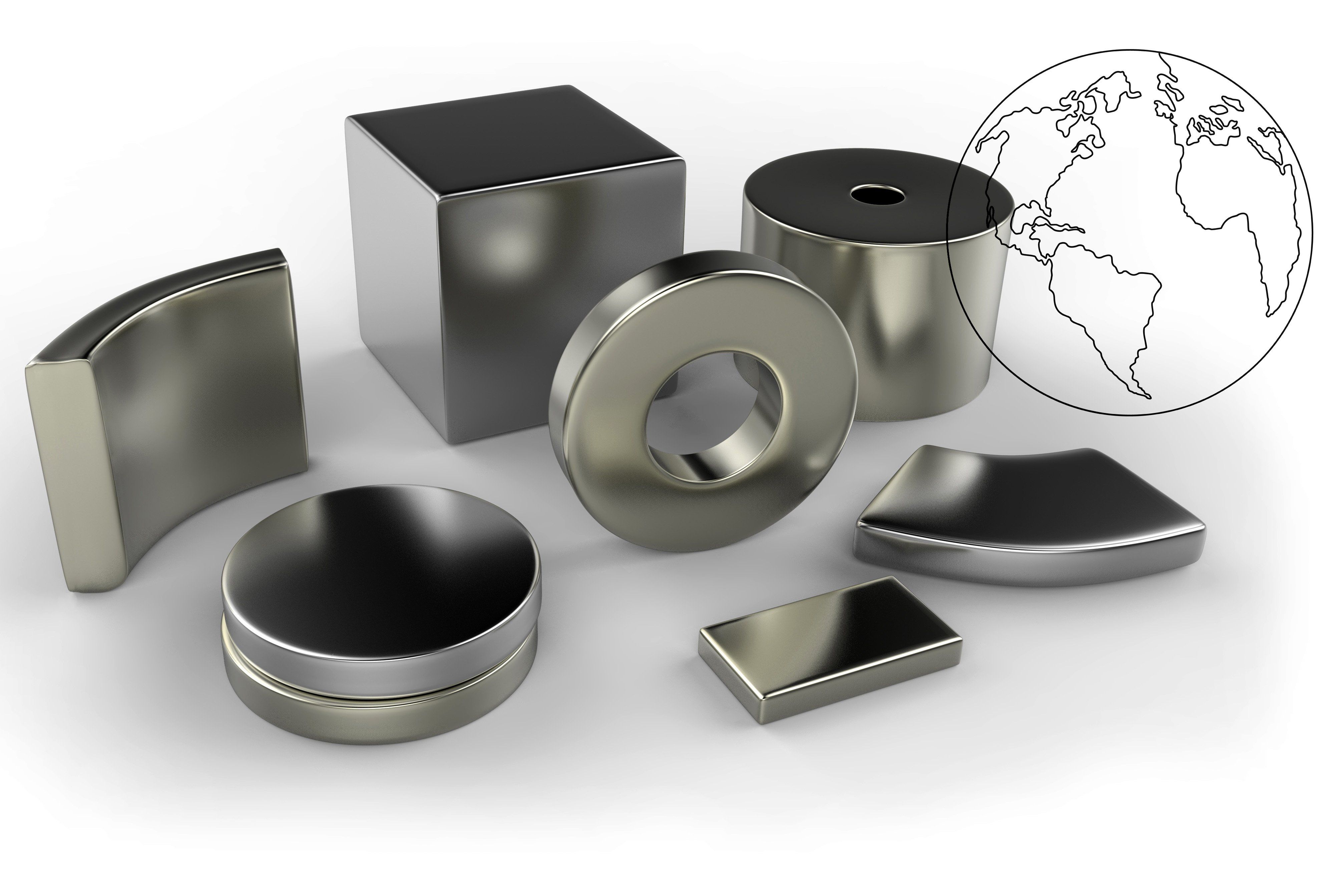

Rare earths are critical in electric vehicles, renewable energy, military applications and high-tech industries. Demand for rare earth metals such as neodymium, dysprosium, praseodymium and yttrium is increasing alongside technological advancements, particularly as artificial intelligence technology gains further importance.

Ongoing tensions between the US and China, along with other geopolitical factors, are impacting the outlook for rare earths investing. Since China is the world’s largest producer of rare earths by far, the fraught relationship between the countries is directing attention to global supply chain disruption in the rare earths industry.

In 2024, 70 percent of US rare earths imports originated from China. While the United States is the second largest producer of rare earths, it trails China significantly, and its known rare earth reserves make up just 2 percent of total global reserves.

With that in mind, it’s worth being aware of rare earths production by country. Here’s a look at the 10 countries that mined the most rare earths in 2024, as per data from US Geological Survey (USGS).

1. China

Rare earths production: 270,000 metric tons

In 2024, China’s domestic output of rare earths was 270,000 metric tons, up from 255,000 metric tons the previous year.

As mentioned, China has dominated rare earths production for quite some time. While China dominates global production of the vast majority of the 17 different rare earth elements, its output is heavily concentrated in light rare earths, specifically the magnet rare earths neodymium and praseodymium.

The largest rare earth mining company in the world is China Northern Rare Earth High-Tech (SHA:600111), which owns the prolific Bayan Obo rare earth mining complex in Inner Mongolia.

Chinese producers must adhere to a quota system for rare earths production. Interestingly, this system has led China to become the world’s top importer of rare earths since 2018.

The quota system is a response to China’s longstanding problems with illegal rare earths mining. For more than a decade, the country has taken steps to clean up its act, including shutting illegal or environmentally non-compliant rare earths mines, and limiting production and rare earths exports.

China’s rare earths industry is controlled by state-owned miners, in theory allowing China to keep a strong handle on production. However, illegal rare earths extraction remains a challenge, and the Chinese government continues to take steps to curb this activity.

The Chinese government is set to introduce even tougher regulations requiring companies involved in the mining, smelting and trading of rare earths to maintain detailed records of product flow and input this data into a traceability system. These new regulations took effect in October of 2024.

2. United States

Rare earths production: 45,000 metric tons

The US produced 45,000 metric tons of rare earths in 2024, up from 41,600 metric tons in the previous year.

Rare earths supply in the US currently comes only from the Mountain Pass mine in California, which is owned by MP Materials (NYSE:MP). Mountain Pass is producing high-purity neodymium and praseodymium (NdPr) oxide, a key material for high-strength neodymium iron boron (NdFeB) magnets.

The mine has had an interesting decade. Previously owned by Molycorp, the mine was put on care and maintenance in 2015 due to low rare earths prices and Molycorp filing for bankruptcy. Mountain Pass re-entered production in Q1 2018 under its new ownership.

The US is a major importer of rare earth materials. The USGS estimates the value of US rare earth imports for 2024 at US$170 million, down from US$186 million in 2023. The country has classified rare earths as critical minerals, a distinction that has come to the fore due to trade issues between the US and China.

Aiming to bolster its domestic supply, in May 2024, the US Biden administration announced a 25 percent tariff on rare earth magnet imports from China that would go into effect in 2026.

New US President Donald Trump is keen on securing the nation’s critical minerals and rare earths supply chain, going so far as to threaten annexation of Greenland and Canada, both home to significant reserves of rare earths and other critical minerals. He also made access to rare earths a major sticking point in a defense deal with Ukraine.

3. Myanmar (also known as Burma)

Rare earths production: 31,000 metric tons

Myanmar produced 31,000 metric tons of rare earths in 2024. This was a decrease of more than 27 percent from the 43,000 MT of rare earths Myanmar mined in the previous year, but still up more than 158 percent from the 12,000 the nation produced in 2022. Supply was down that year due to a temporary halt in production associated with the turmoil following the 2021 military coup.

Myanmar’s rare earths industry is plagued with controversy as much is reportedly carried out by unregulated small-scale miners and linked with armed militia groups with no environmental best practices or remediation plans in place. Ironically, the act of mining these metals critical for clean energy technologies such as EVs and wind turbines is itself fraught with environmentally destructive practices that are harming the waterways, wildlife and vegetation in Myanmar.

China, who shares a border with Myanmar, obtains 70 percent of its medium to heavy rare earths feedstock from its neighbor, including dysprosium and terbium. Myanmar’s rare earths production, and hence China’s feedstock supplies, experienced further disruptions in late 2024. Myanmar’s Kachin Independence Army seized two towns in Kachin state, near China’s Yunnan province, which are critical suppliers of rare earth oxides to China. This includes Panwa, a key rare earths mining hub.

4. Australia

Rare earths production: 13,000 metric tons

In 2024, Australia’s rare earths production came in at 13,000 metric tons, down from 16,000 metric tons in the previous year. That’s compared to the 24,000 metric tons produced in 2021. The country holds the world’s fourth largest rare earths reserves and is poised to increase its output.

Through Geoscience Australia’s Critical Minerals Research and Development Hub, the Government of Australia is looking to accelerate development of the nation’s rare earths resources. Additionally, the government’s National Reconstruction Fund has committed AU$200 million for the development of Arafura Rare Earths’ (ASX:ARU,OTC Pink:ARAFF) Nolans rare earths project in the Northern Territory, as well as AU$400 million to Iluka Resources (ASX:ILU,OTC Pink:ILKAF) for the construction of its Enneaba rare earths refinery in Western Australia.

The leading producer of rare earths outside of China, Lynas Rare Earths (ASX:LYC,OTC Pink:LYSCF) operates the Mount Weld mine and concentration plant in Western Australia. Mount Weld ranks among the world’s top rare earth mines. Lynas is slated to complete its expansion project to boost annual production of NdPr products to 12,000 MT in 2025.

Australian company Northern Minerals (ASX:NTU,OTC Pink:NOURF) is undertaking a feasibility study for its Browns Range mining and process plant; the study is due for completion in Q4 2025. Browns Range’s main products will be heavy rare earths terbium and dysprosium.

5. Nigeria

Rare earths production: 13,000 metric tons

Nigeria’s rare earths production in 2024 was 13,000 metric tons, up more than 80 percent over the previous year’s output level. The African nation is a newcomer to the ranks of the top 10 rare earths producing nations. As Nigeria’s rare earths mining industry is still in the early stage of its development, little is known about the extent of its rare earths reserves at this time.

In late 2024, the government of Nigeria signed a memorandum of understanding with the government of France to jointly develop critical minerals including rare earths.

6. Thailand

Rare Earths production: 13,000 metric tons

Thailand’s rare earths production came in at 13,000 metric tons in 2024, up a whopping 261 percent from the prior year. The country’s rare earth production has ramped up rapidly in recent years — Thailand’s output of rare earths in 2018 was just 1,000 metric tons.

While there’s not much information available on Thailand’s rare earth industry, the country is a major source of rare earth imports for China. As far as downstream rare earths product makers, Neo Performance Materials’ (TSX:NEO) subsidiary Neo Magnequench operates a rare earth magnetic materials manufacturing facility in Korat, Thailand.

Chinese electric vehicle giant BYD (OTC Pink:BYDDF,HKEX:1211,SZSE:002594) opened a US$486 million EV manufacturing facility in the country last July. The Financial Times reports that ‘analysts expect Chinese EV makers to penetrate further into south-east Asia because Thailand has lower tariffs on fully assembled EVs for companies that have pledged to build EV factories there, and most of them are Chinese.’

7. India

Rare earths production: 2,900 metric tons

India’s 2024 production was 2,900 metric tons, unchanged from the previous few years. The country’s output represents less than 1 percent of global rare earths supply. India’s rare earths production is far below its potential, considering the nation holds almost 35 percent of the world’s total beach sand mineral deposits, which are significant sources of rare earths.

India joined the Minerals Security Partnership (MSP) in mid-2023, a multi-nation group led by the United States and focused on the creation of critical mineral supply chains, including for rare earths.

Much of the country’s rare earth exploration and mining is being conducted under the auspices of the Government of India via IREL, which was formed as Indian Rare Earths Limited in 1950. Furthermore, the government is establishing research and development into new technologies for extracting and processing rare earth minerals.

8. Russia

Rare earths production: 2,500 metric tons

Russia produced 2,600 metric tons of rare earths in 2024, nearly the same level as the previous six years. In terms of global rare earths reserves, Russia ranks fifth.

Prior to the country’s aggressive war against Ukraine, the Russian government was allegedly “unhappy” with its supply of rare earths. The Russia-Ukraine war has raised concerns over disruptions to the US/Europe rare earths supply chain.

Russia has reportedly reduced mining taxes and offered discounted loans to investors in nearly a dozen projects intended to increase the nation’s share of global rare earths production from the current 1.3 percent to 10 percent by 2030.

The country’s largest rare earths deposit, Tomtor, is currently being developed by TriArk Mining, a joint venture owned by industrial conglomerate Rostec and billionaire Alexander Nesis. However, in November 2024 Reuters reported that Russian President Vladimir Putin accused the company of delaying its development and suggested partnering with a third party, such as the state, or raise investment.

In late February 2025, Reuters reported that the Russian government has signaled to the Trump Administration that it is interested in a rare earths development deal with the US.

9. Madagascar

Rare earths production: 2,000 metric tons

Madagascar produced 2,000 metric tons of rare earths in 2024, nearly on par with the previous year’s 2,100 metric tons of output and down dramatically from 6,800 metric tons in 2021.

The country’s Ampasindava peninsula is reportedly home to 628 million metric tons of ionic clays with a significant concentration of rare earths, particularly dysprosium, neodymium and europium. It’s considered one of the largest rare earth deposits outside China. Whether or not it is ever developed is up in the air.

The declining in rare earths production in recent years is due in large part to increasing opposition to rare earths mining on the part of farmers who are strongly against mining activity in their communities.

In April 2024, Energy Fuels (TSX:EFR,NYSEAMERICAN:UUUU) agreed to acquire Base Resources and its advanced Toliara heavy mineral sands project in Southwest Madagascar. Energy Fuels plans to separate monazite sands from Toliara’s Ranobe deposit at its White Mesa mill in Utah, US.

10. Vietnam

Rare earths production: 300 metric tons

Vietnam’s rare earths production came in at 300 metric tons in 2024, on par with the prior year’s output. However, it’s down 75 percent from the 1,200 metric tons produced in 2022. Vietnam holds the world’s sixth largest known rare earths reserves, including several rare earth deposits against its northwestern border with China and along its eastern coastline.

The country’s government is interested in building its clean energy capacity, including solar panels, and is said to be looking to produce more rare earths for its supply chain for that reason. It has set a goal of extracting and processing 2 million metric tons of rare earths per year by 2030.

However, serious corruption charges in October of 2023 that led to the arrests of top industry executives, including the chairman of Vietnam Rare Earth JSC, has hamstrung those plans. ‘The arrests stalled government plans to auction new rare earth mining concessions and cast a cloud of uncertainty over the industry that has given foreign investors pause,’ reported Asia Times.

Securities Disclosure: I, Melissa Pistilli, hold no direct investment interest in any company mentioned in this article.